Ever puzzled whether or not it’s best to put money into particular person shares or go for an ETF as a substitute?

It’s a typical query for each novices and seasoned buyers, and the reply isn’t at all times simple.

On the floor, shares and ETFs appear related, and it’s true they each provide you with publicity to the market.

However beneath that floor are key variations that may form your investing journey in another way.

Understanding them is essential for making choices that align along with your targets, threat tolerance, and the way concerned you need to be in managing your portfolio!

On this article, you’ll discover:

- What ETFs are and the way they work

- The various kinds of shares, from small-to-large-cap firms

- Key variations between ETFs and shares, together with diversification, price, and administration kinds.

- The dangers concerned with each investments and easy methods to handle them

- Actual-life examples of various shares and ETFs to see how they evaluate

- Methods to resolve which possibility matches your life-style— and whether or not combining each is sensible

By the tip, you’ll higher perceive which path fits you greatest.

Able to dive in?

What Are ETFs?

Effectively, when you’ve ever puzzled how one can put money into a variety of shares, bonds, or commodities with out having to choose particular person belongings, that’s precisely what Change-Traded Funds (ETFs) might help you with.

Actually, ETFs are some of the widespread funding instruments at this time, providing a easy approach to diversify your portfolio whereas maintaining prices low.

Whether or not new to investing or a seasoned dealer, ETFs can play a priceless position in your technique.

So let’s break it down.

Understanding ETFs: How They Work

Consider an ETF as a basket of belongings.

It may maintain shares, bonds, commodities, and even a mixture of totally different investments.

It may very well be a bit like a playlist of shares; as a substitute of choosing particular person songs (shares), you would possibly get one thing customized that aligns with a selected theme, resembling tech shares, healthcare, or the general market.

And the very best half?

ETFs may be traded on the inventory alternate – identical to particular person shares!

What does this imply?

You should purchase and promote them all through the buying and selling day at their given market costs.

Make sense?

Good!

Now, let’s take a look at passive vs lively exchange-traded funds.

Passive vs. Lively ETFs

Most ETFs comply with a passive funding technique, which tracks a selected index – just like the S&P 500 or NASDAQ-100.

These kind of funds don’t attempt to beat the market; they merely mirror its efficiency.

This retains prices low and makes them splendid for long-term buyers whereas staying fairly secure.

Alternatively, actively managed ETFs have skilled fund managers who make funding choices to try to outperform a sure benchmark (a share, for instance.)

Whereas this strategy provides extra flexibility, it usually comes with larger charges and larger dangers in comparison with passive ETFs.

That’s to not say it’s higher or worse!

These are totally different choices for various eventualities.

Totally different Varieties of ETFs

There are lots of totally different ETF varieties, every matching differing funding methods.

Listed here are a number of the most typical:

- Broad Market ETFs – Monitor main indices just like the S&P 500 or MSCI World Index, exposing you to tons of of firms directly.

- Sector ETFs – Concentrate on particular industries resembling know-how, healthcare, or power, permitting you to put money into specific market segments.

- Worldwide ETFs – Present publicity to markets exterior your house nation, together with rising and developed economies.

- Commodity ETFs – Allow you to put money into bodily belongings like gold, silver, or oil without having to personal the precise commodities.

- Bond ETFs – Supply entry to authorities or company bonds, making them a preferred alternative for income-focused buyers.

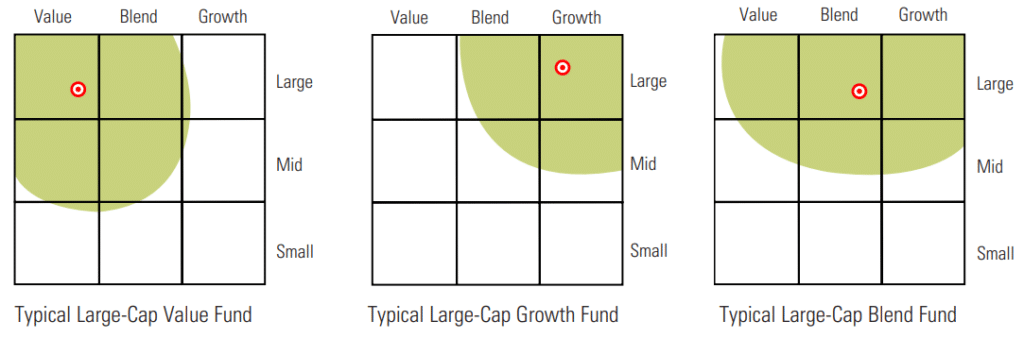

ETFs will also be weighted in the direction of a selected objective, and magnificence packing containers might help mirror which path they’re aiming for…

Type Field – Typical Fund Funding Technique:

Picture by Morningstar.com

Actually, ETFs have exploded in reputation, reaching US$11.1 trillion in belongings beneath administration (AUM) as of December 31, 2023.

However why?

Why ETFs Are So Standard

One of many largest benefits of ETFs is their price effectivity.

They usually have decrease charges than mutual funds, making them a sexy possibility for novices and skilled buyers.

Moreover, ETFs supply diversification by decreasing the chance and spreading your funding throughout a number of belongings.

In addition they supply flexibility by permitting you to commerce them like shares, shopping for and promoting anytime throughout market hours.

And at last, they provide transparency – most ETFs disclose their holdings every day, so that you at all times know what you’re investing in.

Proper – now that you just’ve taken a take a look at ETFs, let’s dive into shares!

What Are Shares?

Should you’ve ever dreamed of proudly owning part of a serious firm like Apple, Tesla, or Amazon, then shares are a manner to try this!

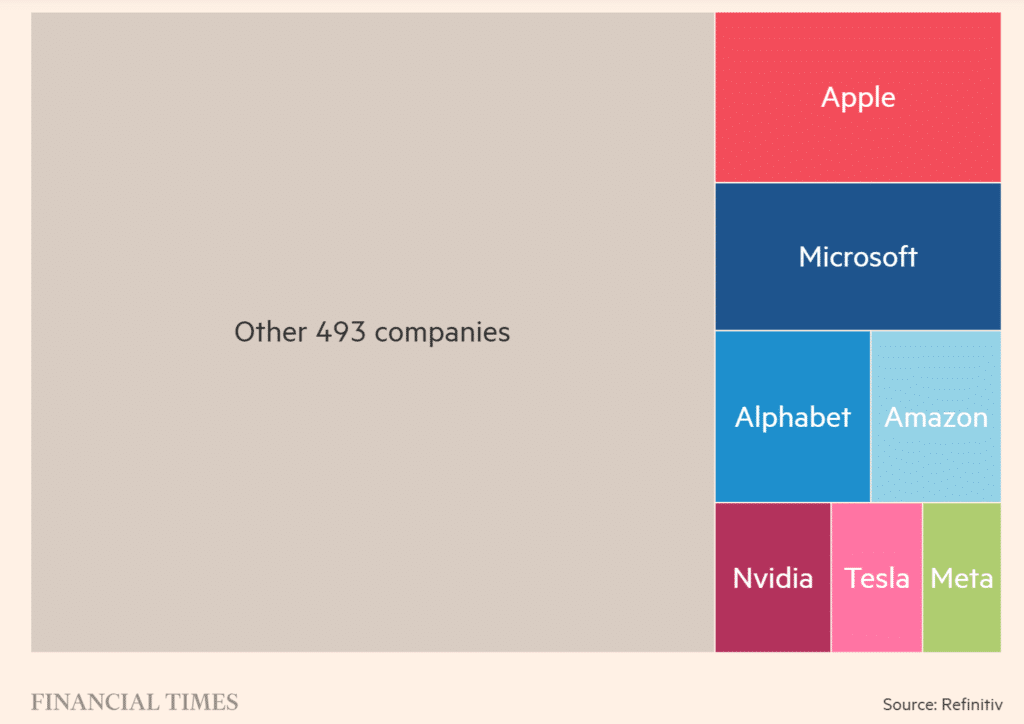

Share of the S&P 500 Index in accordance with market capitalization

Financialtimes.com

Shares, also referred to as shares or equities, symbolize possession in an organization.

If you purchase a inventory, you’re not simply buying a bit of paper or a quantity on a display screen. You’re turning into a partial proprietor of that firm.

How can that be, precisely?

Let’s break it down additional.

Understanding Shares: What Does It Imply to Personal a Share?

As talked about earlier than, at its core, a ‘inventory’ or ‘share’ is a bit of an organization.

When a enterprise needs to lift cash, it may possibly promote shares to the general public via an preliminary public providing (IPO).

Buyers can then purchase and commerce them on the inventory market.

Proudly owning a inventory means you possess a declare to a portion of the corporate’s belongings and earnings.

The extra shares you personal, the bigger your stake within the firm.

Now, inventory possession doesn’t imply you get to stroll into the corporate’s headquarters and begin making choices! (that’s reserved for main shareholders and board members – VIPs solely!)

They do include benefits although…

The Advantages of Inventory Possession

Proudly owning shares generally is a highly effective approach to construct wealth over time.

One of many major advantages is capital appreciation.

As an organization grows and will increase in worth, its inventory value usually rises.

Buyers who purchase shares at a cheaper price can later promote them for a revenue, making inventory possession a sexy long-term funding technique.

One other benefit is dividends.

Some firms, significantly well-established ones, distribute a portion of their earnings to shareholders as common money funds.

These dividends can present buyers with a gradual revenue stream, making them particularly interesting for these trying to generate passive revenue.

Moreover, proudly owning sure sorts of shares comes with voting rights.

Shareholders can participate in necessary firm choices, resembling electing board members or approving main company insurance policies.

Whereas particular person buyers could not have a lot affect (until they personal a big variety of shares,) this side of inventory possession offers buyers a voice within the firms they assist.

These advantages, progress potential, revenue technology, and participation in company decision-making make shares a vital a part of many funding methods.

Nonetheless, in addition they include dangers, which we’ll discover later within the comparability with ETFs.

Notably, not all shares are in the identical league, both…

…I need to present you ways shares are put into teams and settling as soon as and for all between ETFs vs Shares…

Totally different Varieties of Shares: Small, Medium, and Giant-Cap Shares

Shares are sometimes categorized into small-, medium- or large-cap, based mostly on their market capitalization (market cap).

An organization’s market cap represents its complete worth within the inventory market.

These classes assist buyers perceive the chance and progress potential of various shares.

Giant-Cap Shares

These are well-established firms with a market cap of $10 billion or extra.

Consider enormous firms like Apple, Microsoft, and Amazon.

These are recognized for his or her stability, sturdy financials, and constant efficiency.

They are typically much less risky than smaller firms, making them a preferred alternative for long-term buyers.

Many large-cap shares additionally pay dividends, offering a gradual revenue stream along with potential progress.

Mid-Cap Shares

These firms usually have a market cap between $2 billion and $10 billion.

Mid-cap shares symbolize companies which have moved past the startup section however nonetheless have room for enlargement.

They usually supply a steadiness between the soundness of large-cap shares and the expansion potential of small-cap shares.

Examples embrace firms like Etsy or Zillow, which have grown considerably however should not but in the identical league as business giants.

Small-Cap Shares

With a market cap of lower than $2 billion, small-cap shares are sometimes youthful, fast-growing firms with excessive potential for enlargement.

Nonetheless, in addition they include elevated threat, as smaller companies could battle throughout financial downturns.

Whereas some small-cap shares evolve into mid- and large-cap firms, others could face challenges that restrict their progress.

Buyers drawn to small-cap shares usually search high-reward alternatives however should be ready for larger volatility.

Understanding these classes might help you construction your portfolios to match your threat tolerance and monetary targets.

Whether or not you might be aiming for stability, progress, or a mixture of each, market cap performs a vital position in shaping your funding choices.

Okay… so… now for the massive query…

…which one is greatest?

ETFs vs Shares?

Effectively, really, that’s the improper query!

As a substitute of desirous about ‘higher’ or ‘worse’, deal with their variations…

Key Variations Between ETFs and Shares

When deciding between ETFs and particular person shares, working via how they differ might help you select the best choice to your targets.

Whereas each supply alternatives for progress and producing wealth, they differ in diversification, threat, prices, and administration type.

Diversification: Immediate vs. Concentrated Publicity

One of many largest benefits of ETFs is how numerous they are often.

A single ETF can maintain dozens, tons of, and even 1000’s of shares, spreading threat throughout a number of firms, industries, and even international locations.

This makes ETFs an excellent alternative for buyers on the lookout for broad market publicity with out the necessity to analysis and choose particular person shares.

However what if a person inventory throughout the ETF performs exceptionally properly?

Whereas it might assist the efficiency of the ETF, it wouldn’t have the identical influence as when you’d merely invested within the particular person inventory.

This leads me to the subject of shopping for particular person shares – investing in a single firm at a time.

Whereas this will result in substantial positive factors if the corporate performs properly, it additionally exposes the investor to larger dangers if the enterprise faces challenges.

Not like ETFs, which steadiness efficiency throughout a number of belongings, a inventory’s success or failure relies upon fully on its firm’s progress and stability.

So, how do the dangers stack up?

Danger Profile: Stability vs. Potential Volatility

ETFs typically carry decrease threat in comparison with particular person shares.

As they maintain a number of belongings, the decline of 1 firm can usually be offset by higher efficiency from others throughout the ETF.

This built-in threat administration makes ETFs a extra steady possibility, particularly for conservative or new buyers.

Shares, then again, are extra risky by nature.

Costs can fluctuate considerably based mostly on firm earnings, market sentiment, and exterior occasions.

Whereas this volatility presents larger threat, it additionally creates alternatives for larger returns if an investor picks a strong-performing inventory.

These snug with threat and prepared to actively monitor their investments could profit from inventory buying and selling, but it surely requires cautious analysis and technique.

Prices: Administration Charges vs. Transaction Prices

Investing in ETFs normally includes expense ratios, that are small annual administration charges taken as a share of the fund’s belongings.

Whereas these charges are sometimes minimal (starting from 0.03% to 1% usually), they nonetheless cut back general returns over time.

Particular person shares, in contrast, wouldn’t have such ongoing administration charges.

As soon as an investor purchases a inventory, they personal it outright with out further fees past brokerage charges or commissions (which are actually usually negligible resulting from commission-free buying and selling platforms).

Nonetheless, constructing a well-diversified portfolio with shares could require a number of transactions, resulting in larger upfront prices in comparison with shopping for a single ETF.

Administration Type: Passive vs. Lively Investing

ETFs are available in each passively managed and actively managed sorts.

Most ETFs observe an index, such because the S&P 500, that means buyers must do little to no lively decision-making.

Passive investing is nice for individuals who desire a hands-off strategy whereas nonetheless benefiting from long-term market progress.

Some ETFs are actively managed, that means fund managers make common purchase/promote choices.

They cost for his or her experience, although, so actively managed ETFs are inclined to have larger charges.

Examine this passive strategy to investing in shares, nevertheless, which undoubtedly requires lively decision-making.

Buyers should analysis firms, observe monetary stories, and resolve when to purchase or promote based mostly on market circumstances.

Whereas this strategy provides extra management, it additionally calls for important effort and time, making it higher suited for individuals who take pleasure in inventory evaluation and market participation.

Let’s check out some actual chart examples of ETFs and Shares and see how they evaluate to 1 one other.

ETF and Inventory Charts

SPY ETF Day by day Chart:

That is an instance of the SPDR S&P 500 ETF Belief.

This ETF goals to carry a portfolio of widespread shares throughout the S&P 500—providing diversification throughout a number of market sectors.

It’s a massive fund with the important thing objective of getting a mix of firms that present good diversification throughout the market.

The SPY ETF is a wonderful instance of a secure fund that may proceed to yield round that benchmark 10% per 12 months over the long run.

That’s a superb possibility for individuals who need a passive funding that follows the world’s main firms.

Let’s check out one other ETF chart…

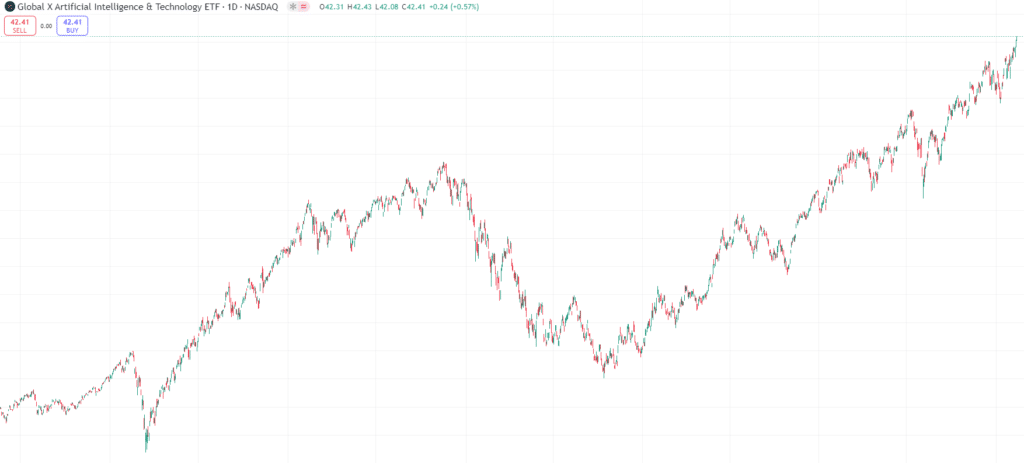

International X Synthetic Intelligence & Expertise ETF (AIQ):

Right here is one other ETF, nevertheless, this time, it’s focusing on a way more distinctive and fewer numerous portfolio.

The fund goals to take a position not less than 80% of its complete belongings in firms and sectors concerned in synthetic intelligence and know-how.

It is a nice instance of an ETF that may align with a present bias of the place issues is perhaps heading, permitting you to nonetheless make funding choices based mostly on up-and-coming industries.

It’s an instance of discovering an edge – focusing on a progress sector with larger threat than a balanced, secure ETF like SPY.

This isn’t to say that this ETF will not be secure, it nonetheless accommodates a variety of firms so as to assist diversify the chance.

As a substitute, dangers would possibly come from unexpected circumstances, resembling governments banning AI know-how or placing main restrictions on the know-how round it.

Whereas unlikely, the likelihood needs to be thought of as if the sector performs poorly, between ETFs vs Shares, the ETF will mirror that.

Now, let’s take a look at some particular person shares…

Apple Inc Day by day Chart (AAPL):

Let’s take Apple, for instance.

On the chart, you’ll be able to see it’s a way more reactive-looking chart in comparison with the regular progress of the S&P500.

But, they’re nonetheless considerably related, proper?

That’s as a result of the SPY ETF really holds round 7% of its holdings as Apple shares.

As Apple is among the largest firms available in the market, it is sensible to have it in an ETF based mostly on the S&P 500.

The distinction right here is that any market fluctuations inside Apple, good or unhealthy, shall be mirrored within the share value and, therefore, your portfolio worth.

There is no such thing as a smoothing out resulting from different firms throughout the sector.

This funding is fully depending on Apple’s efficiency.

Let’s take a look at a smaller firm to check…

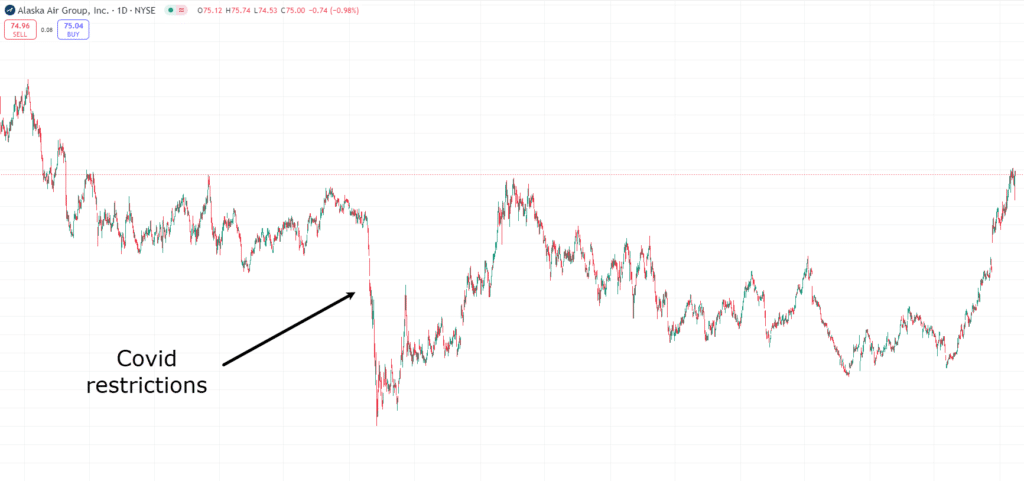

Alaska Air Group (ALK):

Right here is the Alaska Air Group chart, with a market cap within the $9 Billion vary.

This locations it on the larger finish of a mid-cap firm’s $2-10 Billion greenback market cap vary.

Now, take a while to note the variations in charts.

There are loads of peaks and troughs, and the worth appears to be way more risky.

Covid had a devastating influence on airways as borders had been shut and covid restrictions got here into place.

You’ll be able to see it mirrored within the share value, together with the time it took for the worth to recuperate.

So chances are you’ll be considering, “Effectively, it’s not value even taking a look at these types of firms…”

Nonetheless, firms with sturdy foundations that undergo a short market draw back usually present good shopping for alternatives.

Let’s assume you determined to purchase ALK shares when the worth dropped throughout the COVID lockdowns with the data that the airline would ultimately be again up and working.

You’ll have had a 280% share value rise from March 2020 to the present date.

That could be a important improve.

What’s my level?

Selecting particular person shares means that you can choose firms that you just imagine are undervalued.

It means that you can make your individual choices based mostly in your beliefs and analysis in regards to the financial system, market, and the place you assume worth shall be discovered.

In these eventualities, it’s way more essential for detailed evaluation and analysis to be executed whereas timing the market additionally comes into play.

Nonetheless, the positive factors generally is a lot larger than these of ETFs.

So, let’s dive into what type is best for you.

Are ETFs for you?

ETFs is perhaps the right match in case your life-style revolves round a gradual and low-maintenance strategy to investing.

Think about you’re somebody with a busy schedule, and perhaps you’re juggling work, household, and private initiatives.

You don’t have the time to trace particular person shares or continuously monitor the market.

On this case, ETFs supply the peace of thoughts that your investments are diversified, that means you don’t must spend time choosing and monitoring shares.

As a substitute, you’ll be able to set your portfolio and let it develop with minimal involvement.

Or chances are you’ll worth long-term stability over the fun of chasing high-risk, high-reward alternatives.

Once more, ETFs align completely with that mindset.

They unfold your funding throughout many alternative firms, smoothing out the dangers related to any single inventory.

This implies you don’t have to fret about being overly impacted by the sudden value swings of 1 firm’s inventory, permitting you to relaxation simpler figuring out your portfolio is much less risky.

Between ETFs vs Shares, ETFs may be a superb alternative for these planning for the long run, whether or not it’s retirement, shopping for a house, or just rising wealth over time.

It can’t be understated how long-term ETF funding can result in substantial monetary progress.

They mean you can construct a portfolio that steadily appreciates without having to be continuously hands-on.

You don’t should be glued to your pc display screen, ready for the following massive alternative.

With ETFs, you’ll be able to deal with what issues most to you whereas your investments handle themselves within the background.

So, suppose your splendid life-style includes much less stress, extra freedom, and the power to take a position with out continuously managing particular person shares. In that case, ETFs might help you create the monetary basis you could dwell that life.

Sounds nice proper

However what about shares?

ETFs vs Shares: When to decide on Shares?

Particular person shares is perhaps the right alternative in case your life-style thrives on being hands-on and also you’re able to handle your investments actively.

Selecting shares provides a dynamic, participating expertise you probably have the time and power to analysis and analyze firms.

It means that you can put money into companies you imagine have progress potential.

Should you take pleasure in making knowledgeable choices and need to align your investments along with your beliefs about an organization’s potential, shares provide the freedom to take action.

The rewards aren’t simply monetary. They will also be mentally fulfilling.

There’s a singular satisfaction in researching firms, understanding their progress potential, and seeing your funding choices come to life, even when the trail is bumpy.

For these snug with volatility, particular person shares present the chance to expertise extra important ups and downs, reflecting an organization’s efficiency.

However keep in mind, with that potential for larger rewards comes the necessity to handle your threat actively.

Shares require consideration and analysis, however the sky is the restrict for the best funding mindset, with larger potential for larger returns and a extra rewarding investing expertise than ETFs.

Conclusion

In conclusion, selecting between ETFs vs Shares doesn’t must be overwhelming.

It’s about understanding what every provides and the way they align along with your targets and life-style.

By now, it’s best to have a clearer image of how each funding choices work and when one is perhaps extra appropriate than the opposite.

All through this text, you’ve explored:

- What ETFs are and the way they supply diversification

- What shares symbolize and the variations between small-, mid-, and large-cap shares

- The primary variations between ETFs and shares in diversification, threat, prices, and administration type

- When ETFs would possibly go well with a hands-off, long-term strategy to investing

- When shares may very well be splendid for extra management and better progress potential

- Actual-life examples exhibiting how ETFs and shares carry out in numerous eventualities

Investing will not be one-size-fits-all.

What works for another person could not go well with you.

However by understanding these ideas, you’re higher geared up to make knowledgeable choices that align along with your monetary targets and private preferences.

So, what resonates with you extra?

The diversified, set-it-and-forget-it nature of ETFs, or the hands-on potential of particular person shares?

Perhaps a mixture of each is the best match?

Let me know within the feedback beneath about your experiences with ETFs and shares!